Technical Analysis on SOLUSDC: Executing a +44.3% ROI Short Trade

Technical Analysis on SOLUSDC: Executing a +44.3% ROI Short Trade

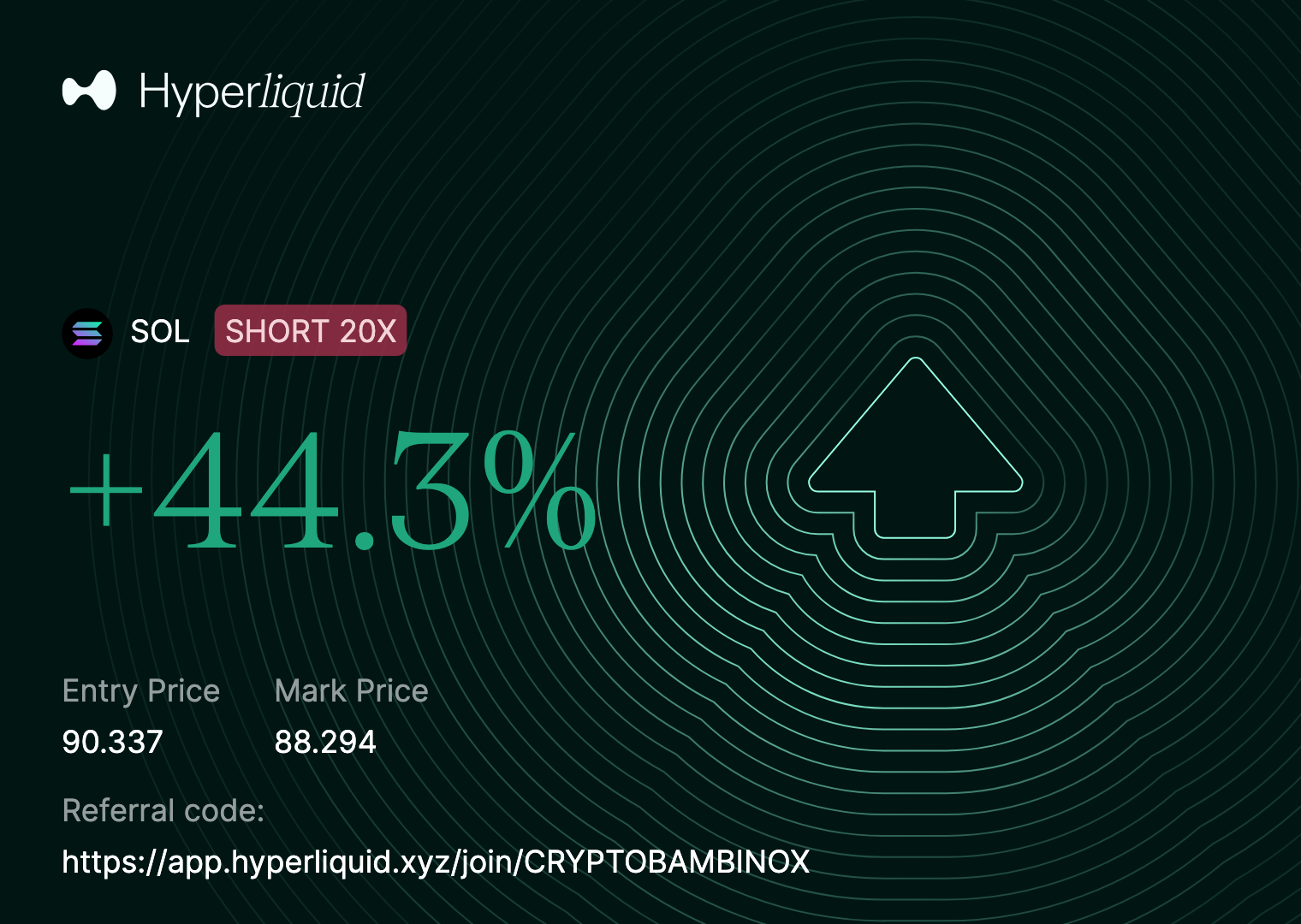

On 5 February 2026, I closed a SOLUSDC short trade on Hyperliquid, capturing +44.3% ROI through confirmation-based execution aligned with bearish structure.

Trade Summary

- Instrument: SOLUSDC

- Position: SHORT

- Leverage: —

- Entry Price: 90.337

- Exit Price: 88.294

- P&L: +44.3%

Technical Analysis: Why I Entered the Short Trade

The short entry at 90.337 was taken after a failed recovery attempt and confirmation that sellers remained in control.

Key technical factors:

Bearish Structure Preservation

SOL continued to print lower highs, confirming that bearish structure remained intact.Rejection From Key Level

Price failed to accept above resistance, signalling a lack of bullish commitment.Momentum Confirmation on Execution Timeframe

Bearish follow-through validated continuation lower without the need for anticipation.

This was a reactive short, not a counter-trend scalp.

Exit Strategy: Covering Into Weakness

This trade was managed as an intraday continuation short, with profits taken methodically into downside expansion.

Exit at 88.294 Into Downside Expansion

The position was closed as price pushed into short-term weakness, locking in gains ahead of any potential bounce.Risk Discipline Over Maximum Capture

The exit respected the plan and prioritised realised gains over chasing additional extension.

Key Takeaways from the Trade

- Shorts work best when structure holds and rallies fail

- Confirmation removes emotional pressure

- Clean execution compounds better than forcing size

As always:

React to what price confirms. Ignore what it suggests.

More SOL executions and structure-based breakdowns coming soon.