Technical Analysis on SOLUSDC: Executing a +149.7% ROI Short Trade

Technical Analysis on SOLUSDC: Executing a +149.7% ROI Short Trade

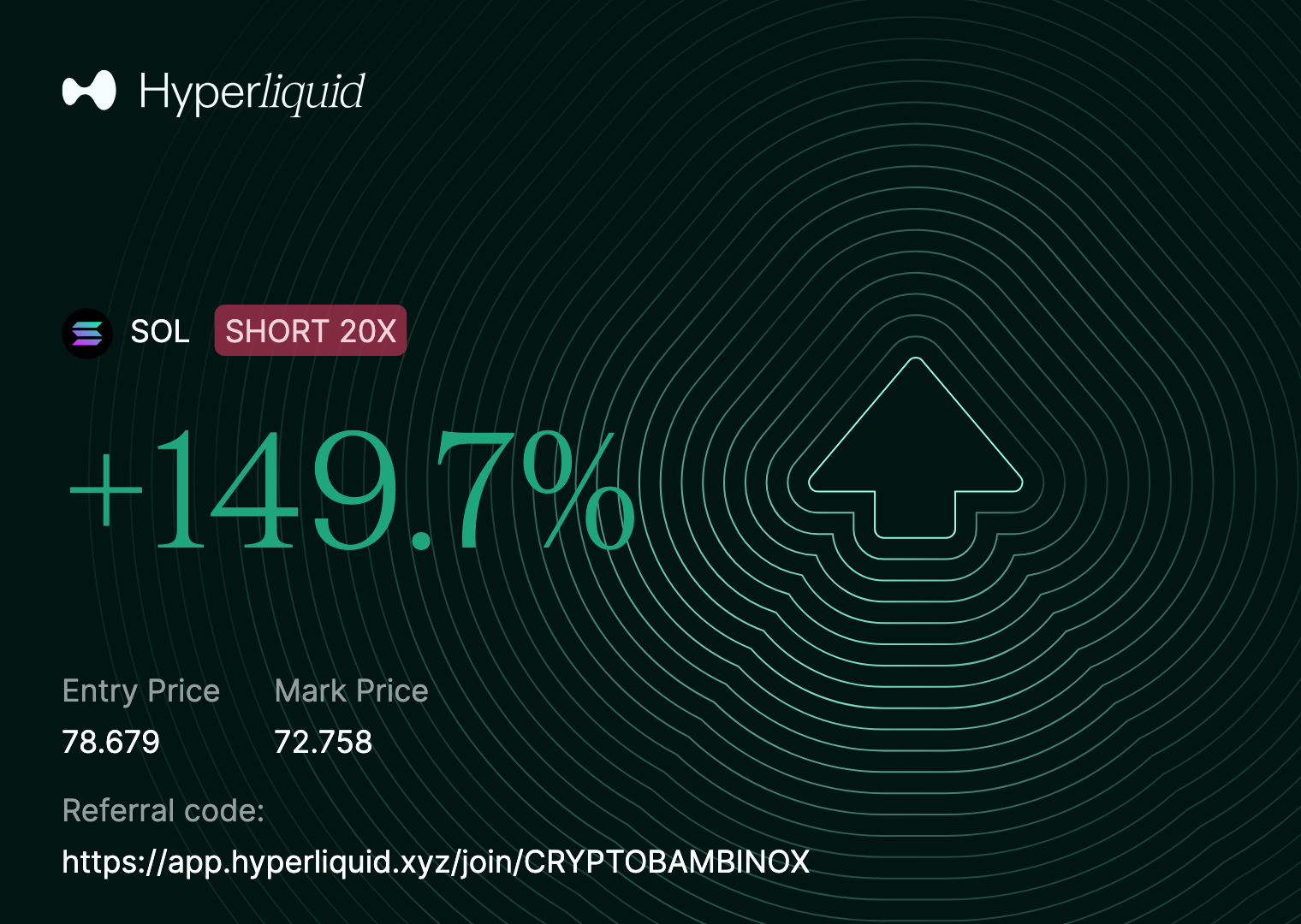

On 6 February 2026, I closed a SOLUSDC short trade on Hyperliquid, capturing +149.7% ROI by aligning with bearish structure and letting downside continuation do the work.

Trade Summary

- Instrument: SOLUSDC

- Position: SHORT

- Leverage: —

- Entry Price: 78.679

- Exit Price: 72.758

- P&L: +149.7%

Technical Analysis: Why I Entered the Short Trade

The short entry at 78.679 was taken after confirmation that bullish recovery attempts had fully failed and downside momentum was in control.

Key technical factors:

Decisive Bearish Structure Shift

SOL failed to reclaim prior support and continued to print lower highs, confirming a bearish regime.Acceptance Below Key Levels

Price accepted below the prior consolidation area, invalidating any bullish continuation scenarios.Strong Downside Momentum Confirmation

Expanding bearish candles and follow-through validated continuation lower without the need to anticipate a top.

This was a confirmation-driven short, not a prediction-based entry.

Exit Strategy: Covering Into Downside Expansion

This trade was managed as a momentum continuation short, with profits taken as price expanded aggressively lower.

Exit at 72.758 Into Downside Extension

The position was closed into weakness after a strong downside leg, locking in gains ahead of any potential reaction.Execution Discipline Over Perfection

The goal was not to catch the absolute low, but to execute cleanly within the plan and protect realised gains.

Key Takeaways from the Trade

- Large returns come from structure + continuation

- Letting winners run requires confirmation, not hope

- Execution discipline compounds faster than prediction

As always:

React to what price confirms. Ignore what it suggests.

More SOL executions and continuation-based breakdowns coming soon.