Technical Analysis on HYPEUSDC: Executing a +33.3% ROI Long Trade

Technical Analysis on HYPEUSDC: Executing a +33.3% ROI Long Trade

On 8 February 2026, I closed a HYPEUSDC long trade on Hyperliquid, capturing a total +33.3% ROI through a confirmation-based entry and scaled profit-taking into strength.

Trade Summary

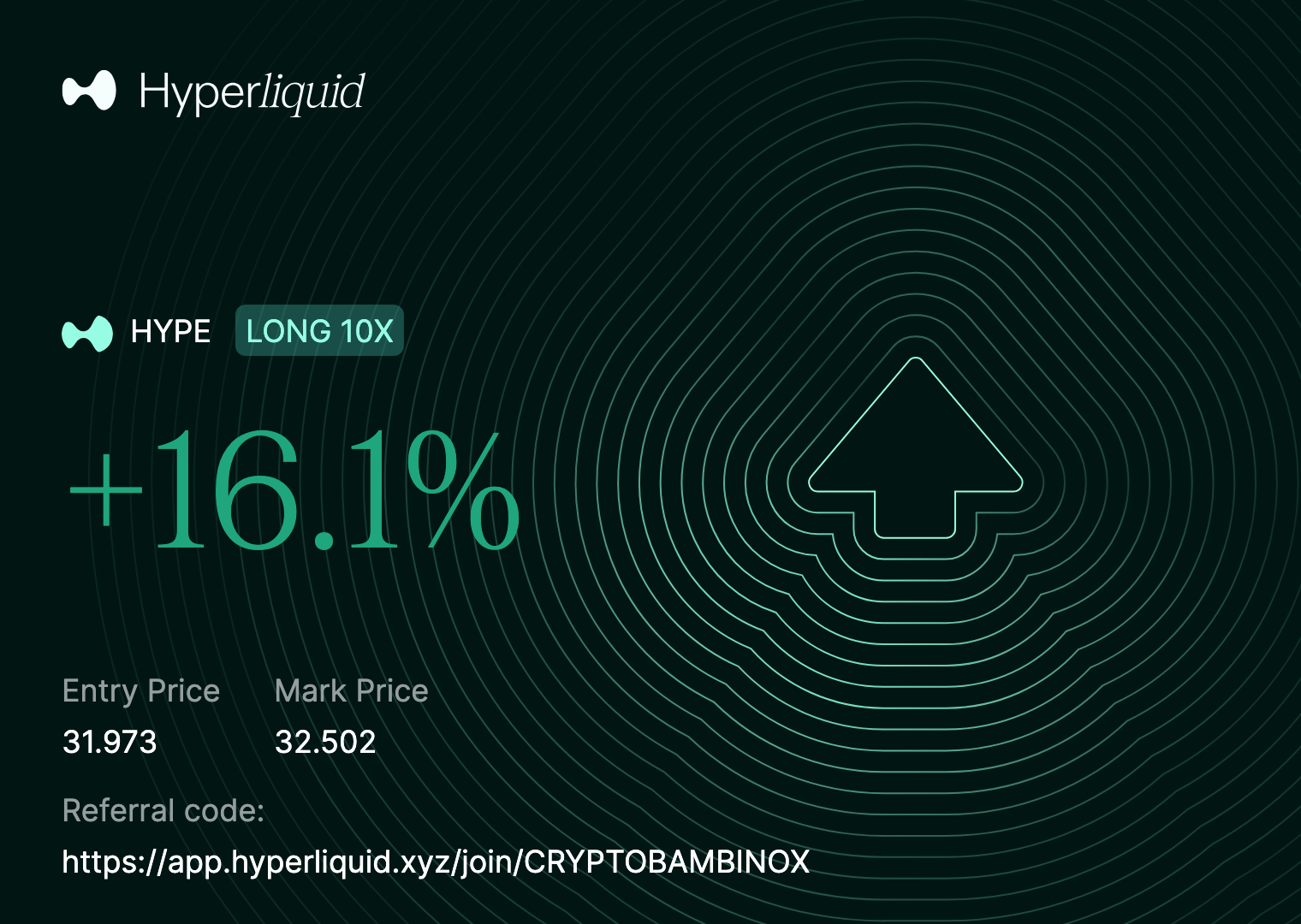

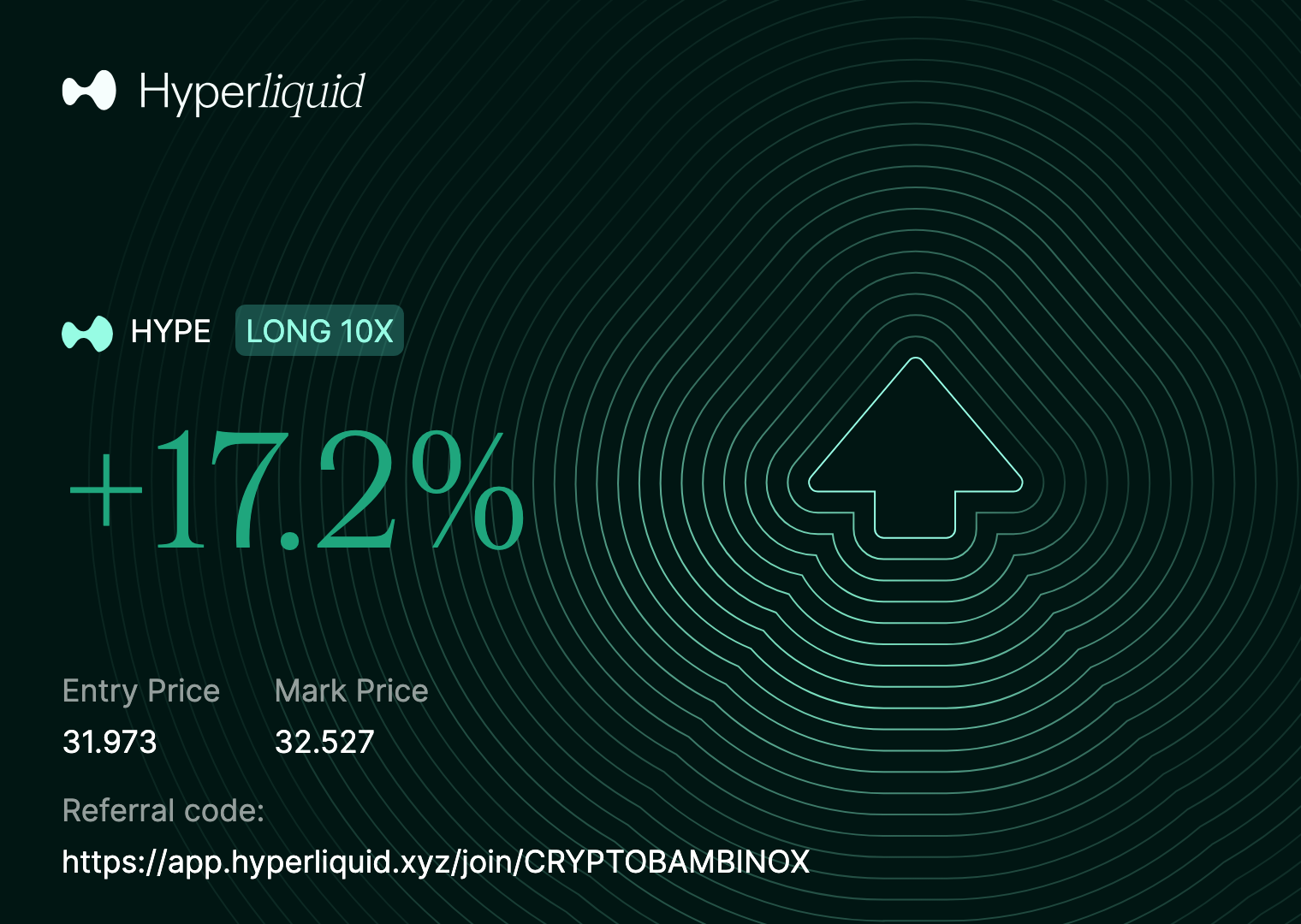

- Instrument: HYPEUSDC

- Position: LONG

- Entry Price: 31.973

- TP1: 32.502

- TP2: 32.527

- Total P&L: +33.3%

Technical Analysis: Why I Entered the Long Trade

The long entry at 31.973 was taken after confirmation that buyers were in control and bullish continuation conditions were present.

Key technical factors:

Bullish Structure Preservation

Price continued to hold higher lows, confirming that bullish structure remained intact.Acceptance Above Key Level

HYPEUSDC accepted above a prior consolidation area, indicating that buyers were defending higher prices.Momentum Confirmation on Execution Timeframe

Bullish follow-through validated continuation without the need to anticipate the move.

This was a confirmation-driven long, not a breakout chase.

Exit Strategy: Scaling Out Into Strength

This trade was managed as an intraday continuation long, using multiple targets to reduce risk and lock in gains.

TP1 at 32.502

Partial profits were taken into the first upside expansion, reducing exposure and securing gains.TP2 at 32.527

The remaining position was closed into further extension, completing the trade with controlled execution.

Key Takeaways from the Trade

- Scaling out improves risk-adjusted returns

- Confirmation keeps drawdown minimal

- Let structure guide entries, let momentum pay exits

As always:

React to what price confirms. Ignore what it suggests.

More real executions and scaled setups coming soon.