Technical Analysis on HYPEUSDC: Executing a +7.2% ROI Long Trade

Technical Analysis on HYPEUSDC: Executing a +7.2% ROI Long Trade

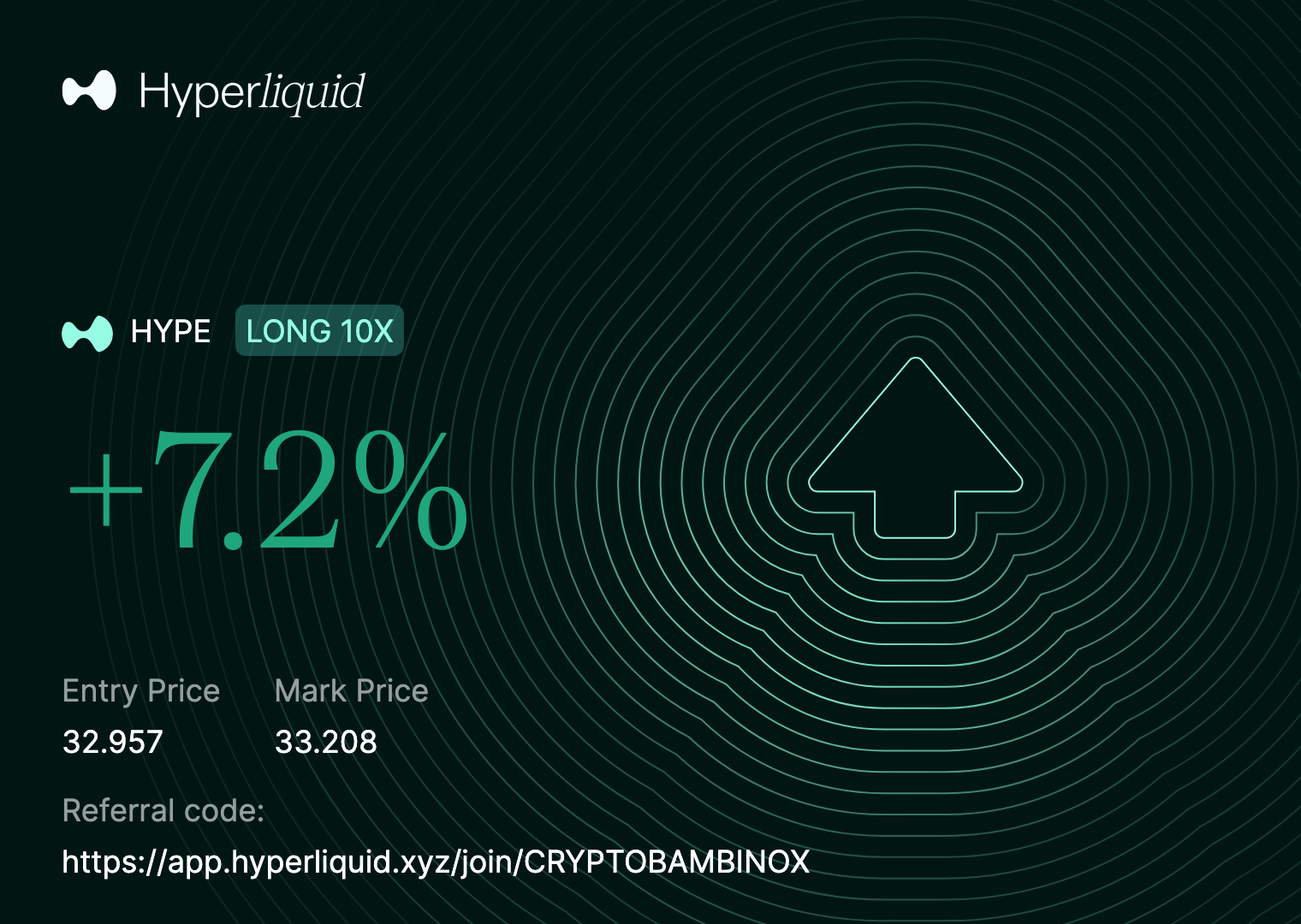

On 3 February 2026, I closed a clean HYPEUSDC long trade on Hyperliquid, capturing +7.2% ROI through confirmation-based execution and disciplined trade management.

This post outlines the rationale behind the entry, how the trade was managed, and why the exit was taken.

Trade Summary

- Instrument: HYPEUSDC

- Position: LONG

- Leverage: 10×

- Entry Price: 32.957

- Exit Price: 33.205

- P&L: +7.2%

Technical Analysis: Why I Entered the Long Trade

The long entry at 32.957 was taken after price confirmed that buyers were in control and that the market was ready to continue higher.

Key technical factors:

Bullish Structure Hold

Price held above the most recent intraday support, maintaining higher lows and preserving the bullish structure.Acceptance Above Key Level

HYPEUSDC accepted above the prior consolidation area, indicating that bids were absorbing sell pressure and defending higher prices.Momentum Confirmation on Execution Timeframe

Strong bullish candles and follow-through confirmed buyer efficiency, validating the long bias and reducing the need for anticipation.

This was a confirmation-driven long, not a hopeful entry.

Exit Strategy: Taking Profit Into Strength

This trade was managed as an intraday momentum long, prioritizing execution quality and risk discipline given the higher leverage.

Exit at 33.205 into Strength

The position was closed as price pushed into short-term upside expansion, locking in profit before any potential pullback or mean reversion.Risk Management with 10× Leverage

At 10× leverage, the goal is always to avoid overstaying. The exit respected the plan and kept exposure tight.

Key Takeaways from the Trade

- Longs perform best when structure holds + acceptance confirms

- Confirmation reduces chop and improves execution quality

- With higher leverage, discipline matters more than targets

As always:

React to what price confirms. Ignore what it suggests.

More real executions and technical breakdowns coming soon.