Technical Analysis on HYPEUSDC: Executing a +17.2% ROI Long Trade on Retest

Technical Analysis on HYPEUSDC: Executing a +17.2% ROI Long Trade on Retest

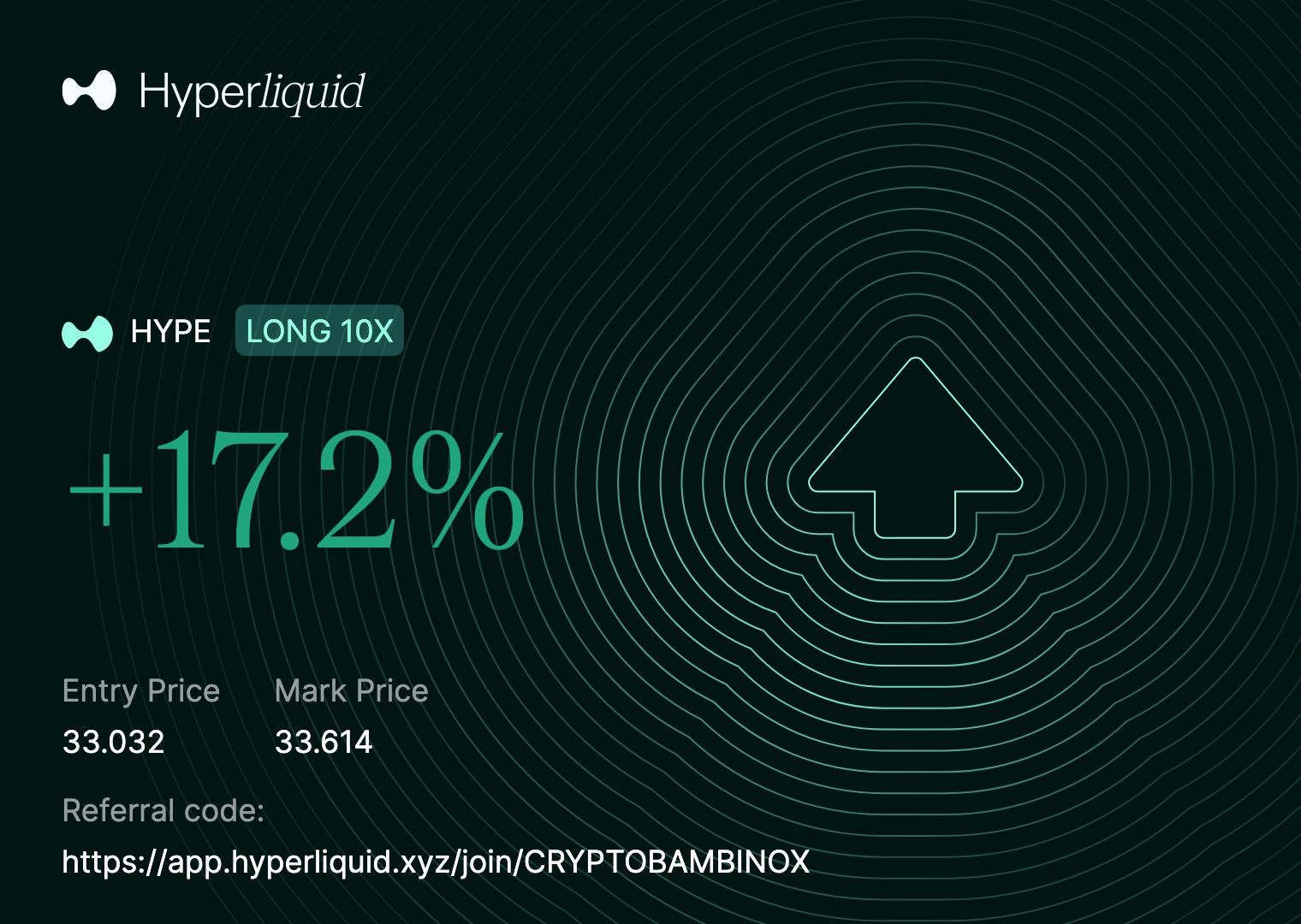

On 3 February 2026, I closed a HYPEUSDC long trade on Hyperliquid, capturing +17.2% ROI using a retest-based continuation entry combined with strict confirmation and risk discipline.

Trade Summary

- Instrument: HYPEUSDC

- Position: LONG

- Leverage: 10×

- Entry Price: 33.032

- Exit Price: 33.614

- P&L: +17.2%

Technical Analysis: Why I Entered the Long on Retest

The long entry at 33.032 was taken after the initial bullish impulse and a controlled pullback, offering a high-quality retest rather than a breakout chase.

Key technical factors:

Bullish Continuation Structure

Price maintained higher highs and higher lows, confirming that the broader bullish structure remained intact.Shallow Pullback and Level Respect

The retrace held above the prior breakout zone, showing that sellers lacked strength and that buyers were defending the move.Retest Confirmation on Execution Timeframe

Bullish reaction and follow-through on the retest validated continuation, allowing for a defined-risk long entry.

This was a reactive retest long, not a momentum chase.

Exit Strategy: Scaling Out Into Expansion

This trade was managed as an intraday continuation long, with leverage dictating disciplined exits.

Exit at 33.614 into Upside Expansion

The position was closed as price accelerated into short-term extension, locking in gains ahead of any potential rotation.Leverage-Aware Risk Control

At 10× leverage, holding through retracements is unnecessary. The trade respected the plan and prioritised capital protection.

Key Takeaways from the Trade

- Retests offer better R:R than breakouts

- Continuation trades work best when structure is preserved

- Leverage rewards precision, not patience

As always:

React to what price confirms. Ignore what it suggests.

More real executions and retest-based setups coming soon.