Technical Analysis on SOLUSDC: Capturing a 5.0% ROI with a Long Trade

Technical Analysis on SOLUSDC: Capturing a 5.0% ROI with a Long Trade

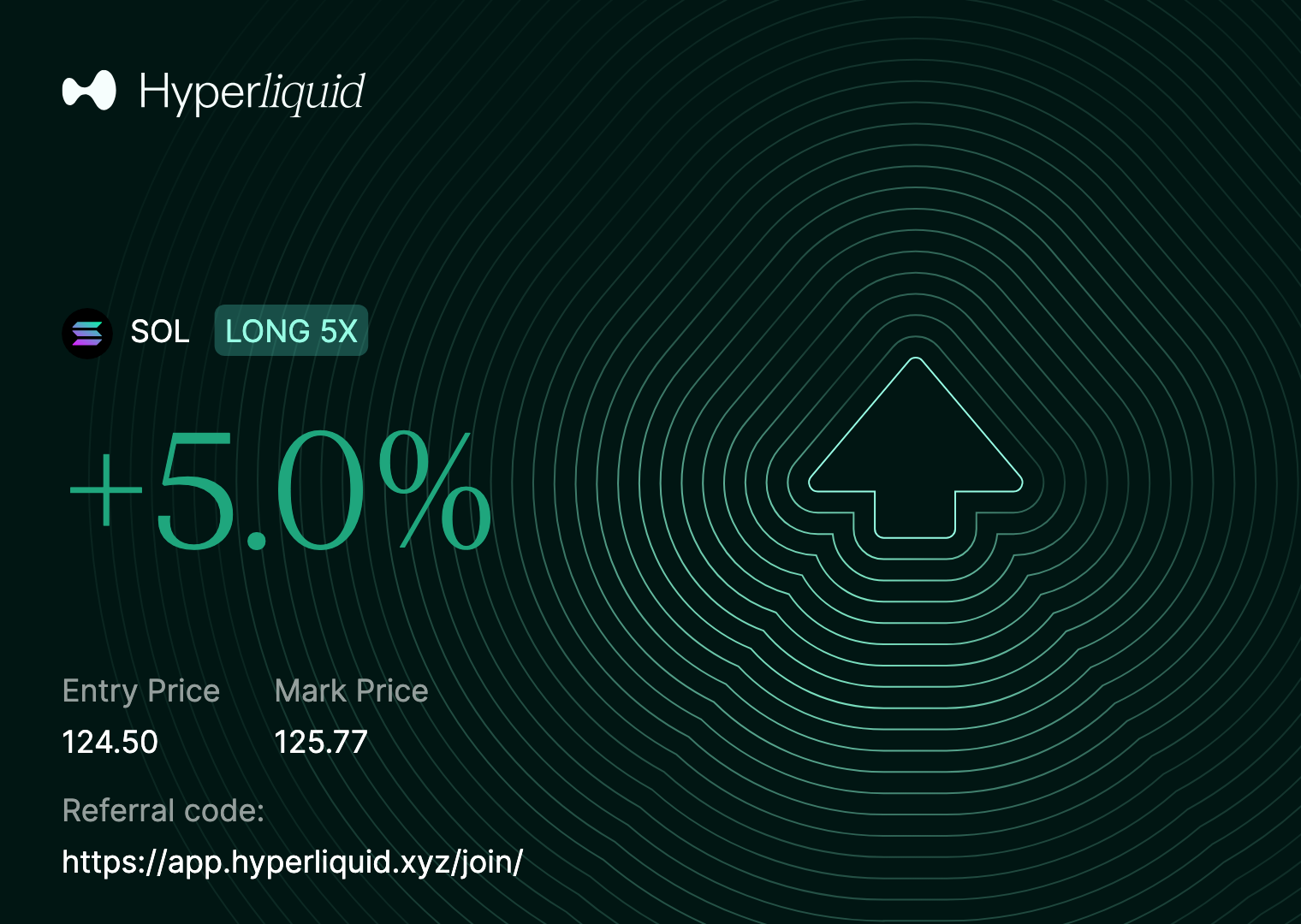

Today, I closed a successful SOLUSDC long trade on Hyperliquid with a 5.0% ROI. This post breaks down the entry and exit points, along with the technical analysis that led to this profitable trade.

Trade Summary

- Instrument: SOLUSDC

- Position: LONG

- Leverage: 5×

- Entry Price: 124.50

- Exit Price: 125.77

- P&L: +5.0%

Technical Analysis: Why I Entered the Long Trade

Upon analyzing SOLUSDC, I identified several technical signals that supported a high-probability long continuation setup:

Bullish Intraday Market Structure

SOLUSDC was trading in a clear intraday uptrend, marked by higher highs and higher lows on lower timeframes. The pullback into the 124.50 area respected previous structure, suggesting continuation rather than reversal.Shallow Pullback into Demand

Price retraced in a controlled manner into a minor demand zone, with no aggressive selling pressure. Shallow pullbacks during strong momentum phases often indicate strength and offer favorable risk-to-reward long entries.Momentum Confirmation on Execution Timeframe

Bullish continuation candles appeared on the execution timeframe, confirming buyer presence and validating the long bias. There were no signs of absorption or distribution against the trend at the point of entry.

Exit Strategy: Locking in Profits at 125.77

After entering at 124.50, the trade was managed as a short-term momentum play, with the goal of capturing intraday continuation rather than holding for an extended move.

Exit into Strength

The position was closed at 125.77 as price pushed into short-term strength. This allowed profits to be locked in without exposing the trade to a potential pullback or consolidation.Risk-Aware Execution

With 5× leverage, the priority was capital preservation and consistency. Exiting decisively ensured the trade remained aligned with the original plan, avoiding over-management or emotional bias.

Key Takeaways from the Trade

This trade highlights the effectiveness of:

- Trading with the trend

- Using structure and momentum rather than prediction

- Executing decisively and respecting the trade plan

Small, repeatable wins like this compound over time when paired with disciplined risk management and consistent execution.

Stay tuned for more trading insights and technical analysis as I continue to document real, executed trades in the crypto market.