Technical Analysis on SOLUSDC: Executing a 2.5% ROI Intraday Long

Technical Analysis on SOLUSDC: Executing a 2.5% ROI Intraday Long

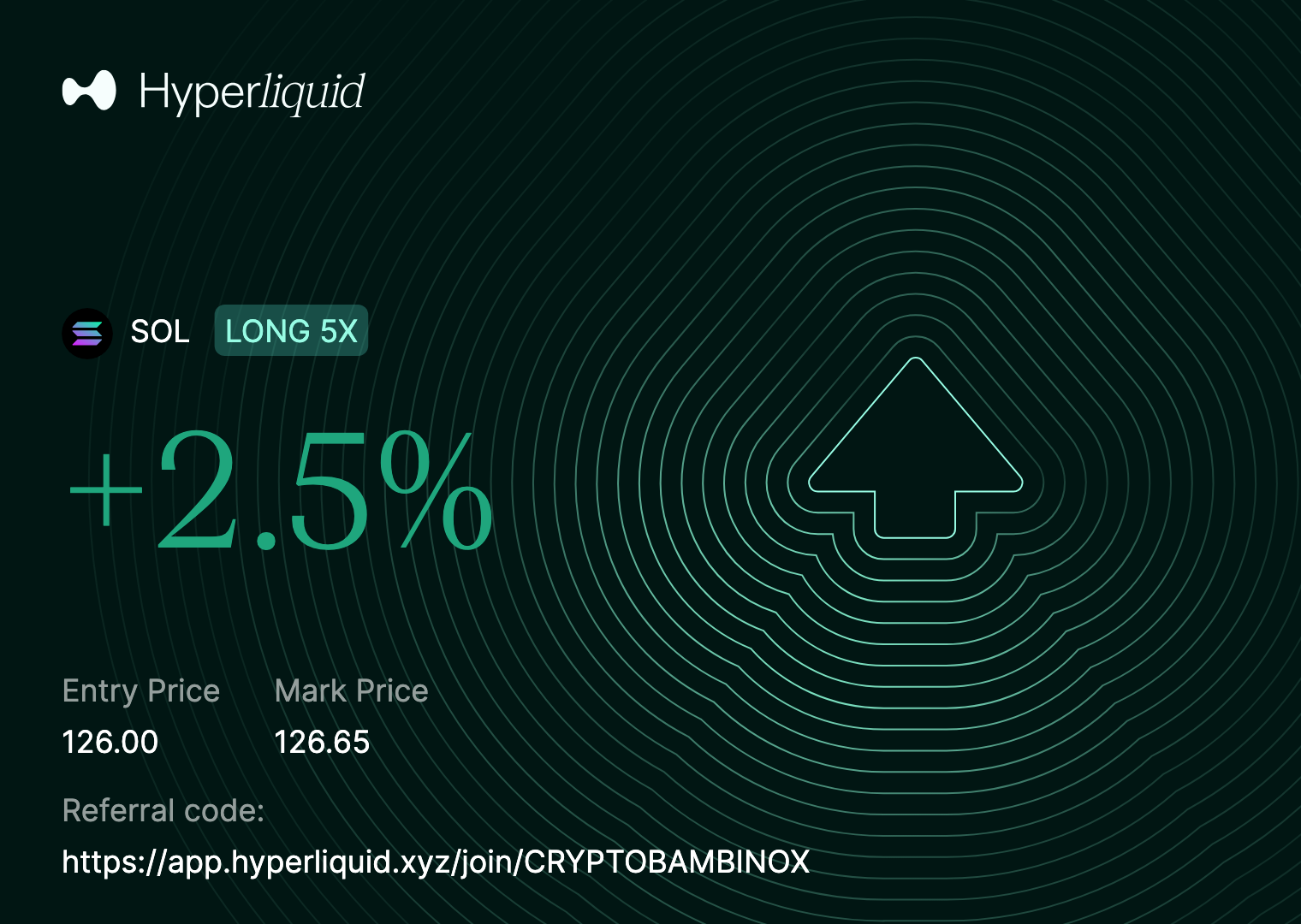

On 27 January 2026, I closed a successful SOLUSDC long trade on Hyperliquid, capturing a +2.5% ROI through disciplined intraday execution.

This post outlines the rationale behind the trade, along with entry, exit, and management logic.

Trade Summary

- Instrument: SOLUSDC

- Position: LONG

- Leverage: 5×

- Entry Price: 126.00

- Exit Price: 126.65

- P&L: +2.5%

Technical Analysis: Why I Entered the Long Trade

The long entry at 126.00 was taken in alignment with a strong intraday bullish structure, focusing on continuation rather than prediction.

Key technical factors:

Trend Continuation Bias

SOLUSDC maintained a clear intraday uptrend, with price holding above prior structure lows. There was no acceptance below key support levels, keeping the bullish bias intact.Acceptance Above Prior Range

Price showed acceptance above the previous consolidation range, signaling buyer control and willingness to defend higher prices.Momentum Confirmation on Entry Timeframe

Bullish continuation candles appeared on the execution timeframe with no meaningful selling pressure, confirming active demand at the point of entry.

Exit Strategy: Closing into Strength

This position was managed strictly as an intraday momentum trade.

Exit at 126.65 into Strength

The trade was closed into short-term strength, locking in gains without exposing the position to potential consolidation or pullback risk.Capital Protection with Leverage

With 5× leverage, discipline and consistency take priority over maximum extension. The exit respected the original plan and avoided overstaying the move.

Key Takeaways from the Trade

- Trend-aligned continuation setups remain high probability

- Confirmation-based execution reduces drawdown and stress

- Consistency compounds faster than chasing larger moves

As always:

Execution over prediction. Process over outcome.

More real executions and technical breakdowns coming soon.