Technical Analysis on SOLUSDC: Executing a 9.1% ROI Short Trade

Technical Analysis on SOLUSDC: Executing a 9.1% ROI Short Trade

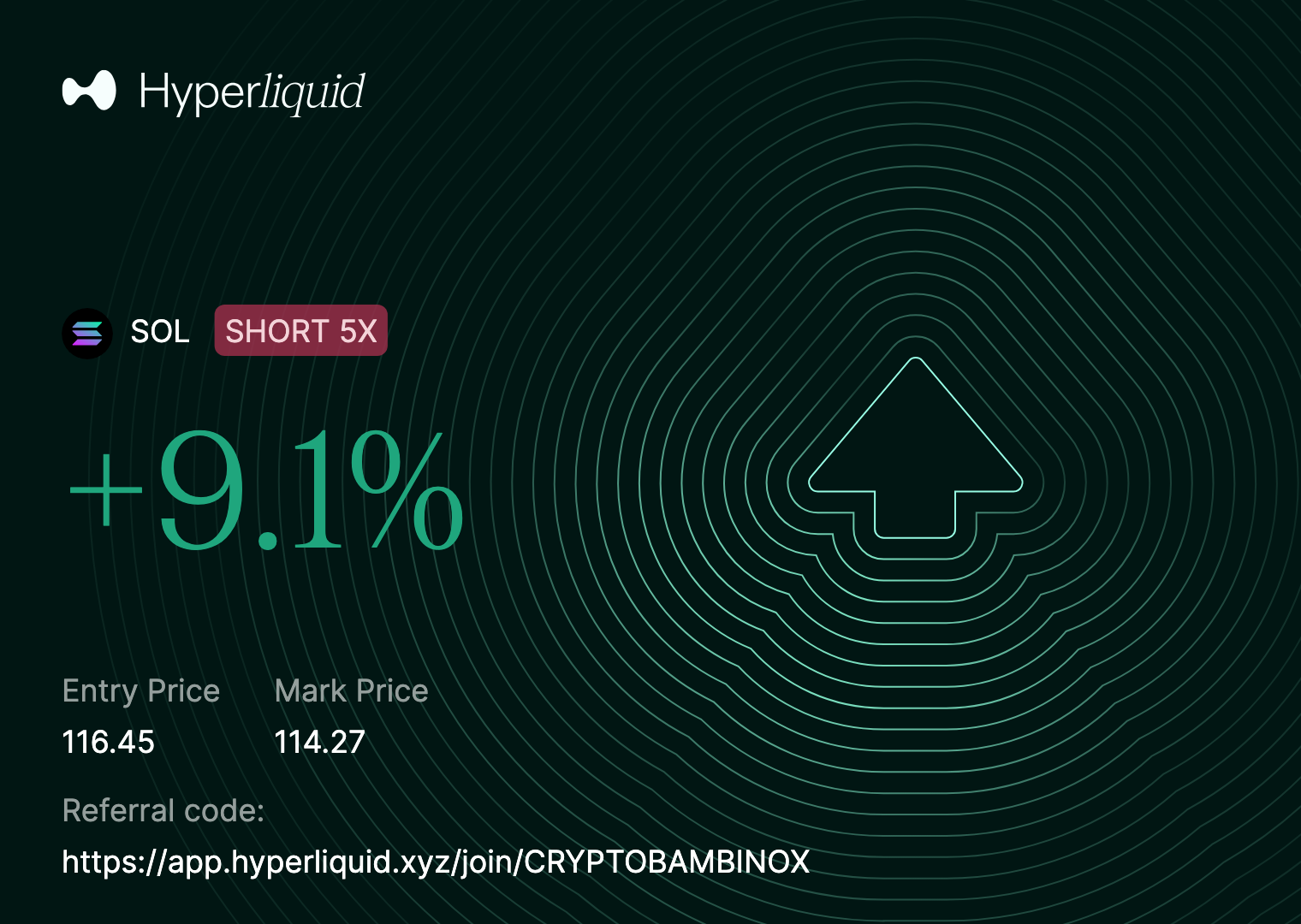

On 31 January 2026 at 14:06, I closed a clean SOLUSDC short trade on Hyperliquid, capturing a +9.1% ROI through disciplined, confirmation-based execution.

This post outlines the technical rationale behind the trade, including entry, exit, and management logic.

Trade Summary

- Instrument: SOLUSDC

- Position: SHORT

- Leverage: 5×

- Entry Price: 116.45

- Exit Price: 114.27

- P&L: +9.1%

Technical Analysis: Why I Entered the Short Trade

The short entry at 116.45 was taken after confirmation that bullish continuation had fully failed and downside momentum was taking control.

Key technical factors:

Loss of Bullish Structure

SOLUSDC failed to hold above prior intraday support, signaling a structural shift from continuation to rotation lower.Acceptance Below Key Levels

Price accepted below the previous consolidation area, confirming that buyers were no longer defending higher prices.Bearish Momentum Confirmation

Strong bearish candles printed on the execution timeframe, showing increasing seller efficiency and validating the short bias.

This was a confirmation-driven short, not an anticipatory entry.

Exit Strategy: Covering into Weakness

The trade was managed strictly as an intraday momentum short, with an emphasis on execution quality and risk discipline.

Exit at 114.27 into Weakness

The position was closed as price expanded lower into short-term weakness, locking in profits ahead of potential demand absorption.Risk Management with Leverage

At 5× leverage, capital preservation remains the priority. The exit respected the trade plan and avoided unnecessary exposure to a bounce.

Key Takeaways from the Trade

- Shorts perform best after structure failure + acceptance

- Confirmation reduces drawdown and emotional pressure

- Clean execution compounds faster than forcing trades

As always:

React to what price confirms. Ignore what it suggests.

More real executions and technical breakdowns coming soon.